Important Payroll and Benefits Information for SY 2022-23

As a new school year gets underway, Payroll and Benefits would like to share relevant information with all employees. Please take the time to review this information.

What's New

PeopleSoft was upgraded over the summer to have a more user-friendly look and feel. You can now access PeopleSoft more easily from a tablet or cell phone. Most importantly, now all employees, including salaried and hourly staff, will enter their own time worked/absent each week. We recognize this is going to be new for many people, so to help you become familiar with the system, there are a few interactive tutorials for you to review. In addition, there are some step-by-step reference documents. Please take the time this week to familiarize yourself with the new system, as most actions related to payroll, benefits, and personal changes will now be done through PeopleSoft.

Where to find the tutorials and help sheets: SPPS Payroll Home / Employee Help Sheets

Logging Into PeopleSoft

When you log into PeopleSoft this week, please do two things right away:

- Set up a security question so you can use the “Forgot Your Password” link later if needed. From the main landing page, look for the “Change My Password” tile and click on it. Then, under the General Profile Information, click on the “Change or set up forgotten password help” link.

![]()

- Verify that your supervisor in the system is listed correctly. If it isn’t, please email payroll@spps.org and we can help facilitate getting this corrected. Your time reporting routes to your supervisor listed, and we want your first time report to go to the correct person.

- To view your personal and job information, click on the “Employee Self Service” tile, then the “Company Directory” tile. Then click the “View My Profile” link. On the left-hand side, click on “Reporting Structure” to see the direct supervisor listed.

- Note: If you work at multiple locations and report to more than one supervisor, the system still only allows one. Your supervisor listed should be one where you work the majority of your hours. Some itinerant staff may report to a program area supervisor, not a principal at the building(s) in which they work.

Weekly Time Reporting

All employees, including hourly and salaried staff, must report their time worked/absent every week through Employee Self Service in PeopleSoft. Time reporting is due by Friday of each week, even though payday is every other week. Late timesheets may result in missed paychecks, so it is extremely important that you submit your time promptly.

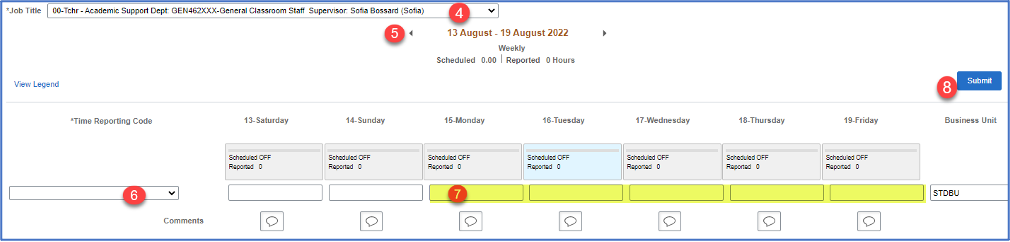

After navigating to the timesheet (steps 1, 2, & 3), select the appropriate job if you have more than one (step 4), use the arrow buttons to scroll to the correct week (step 5), enter your reason code such as present or sick (step 6), and enter your hours each day (step 7). If you have multiple reasons codes in a given week, add a new row (using the + sign to the very right of the row). Finally, click the submit button (step 8). Please refer to the full instructions for more information including the notes section, reporting bereavement leave, etc.

Here are some helpful tips when reporting your time:

- You can enter your hours for a given week any time during that week. You don’t need to wait until Friday. If you end up being out after you report your hours, you can update your hours 6 days after the end of the week. After that, your manager must adjust the time for you.

- You can enter full-week absences several weeks ahead of time. If you will be on vacation or planning a surgery, you can enter each week of your absence before you leave. Note: If there are any hours worked in a given week, the system will not let you pre-enter hours any further in advance than the current week.

- If you work multiple jobs, make sure you are selecting the correct job before entering your hours for that job. Submitting your hours on the wrong job (assignment) will cause your time to route to the wrong supervisor, your pay rate to be incorrect, and the wrong department to be charged for your wages. (Selecting a job to enter hours is at the top of the screen on the timesheet.)

- Salaried employees can only enter a maximum of 40 hours per week even if they work more. If you are salaried and your union contract allows for extra pay for certain types of work such as attending workshops or loss of prep, you should report that additional time on the supplemental pay e-form. (See below for more info on supplemental pay.) Hourly employees who work more than they are scheduled in their regular job should make sure to enter their hours accurately based on what they actually work.

- Contact Payroll if you notice your time is not routed to the correct supervisor. When employees change jobs or transfer to a different building, sometimes there is a delay in the supervisor's information being updated in the system. Payroll can help facilitate getting that information updated so your time routes correctly going forward.

- Set yourself a recurring reminder in your email (or on your phone) to remind yourself to enter your time weekly. We know life gets busy and it’s easy to forget without a reminder. However, the Payroll department is very small compared to the number of employees who get paid. So, if you forget to report your time, you are at real risk of not being paid for that week on the upcoming paycheck. We don’t want that to happen to you. Your best way to avoid this is by setting up a reminder for yourself.

Time reporting help, including step-by-step reference documents and interactive tutorials, are at this link: SPPS Payroll Home / Employee Help Sheets

Supplemental Pay

If you work any periodic additional assignments outside of your regular job that is eligible for payment, it should be submitted as “supplemental pay”, not on your regular timesheet.

- Salaried staff (teachers, SCSP) are not automatically paid for all the extra hours they work. The union contract dictates the type of extra work that is compensated. Some of this is loss of prep, attending workshops, and other general assignments. To be compensated for the extra work eligible for pay, salaried employees must complete the supplemental pay e-form. This is the same e-form as last year. Just look under the “Employee Forms” tile when you log into PeopleSoft.

- Hourly staff (EAs, TAs, clerical) can report extra hours worked that are part of their regular jobs(s) on their regular timesheet. Any work that will be paid out of a budget that is not part of their regular job(s) should be submitted on a paper supplemental form. This is typically limited to internal professional development attended that is sponsored by a specific program area or interpreter work done outside of your regular job. Check with the program area for specifics on completing the paper form. They should have one available for you. At some point later this school year, we anticipate the paper form will be replaced by an electronic form.

Lane Change Information

Any lane changes submitted over the summer are still being processed and may take until late September to be completed. HR and Payroll’s priority is getting new hires set up and ready for their first day. More information about lane changes is on the Payroll website at this link: spps.org/Page/3532

Paycheck Timing

All employees whose first regular duty day back to work occurs any time between Monday, August 29, and Friday, September 9, will see their first paycheck of the 2022-23 school year on Friday, September 23. (Summer pay refunds for employees who participate in the summer pay / 26-pay program continue through the September 9 check.) The full payroll schedule is available for reference at this link: spps.org/Page/24100.

Personal Information Updates

Employees are highly encouraged to review their personal information in PeopleSoft and make updates as needed. Please consider updating your cell phone number so you can receive automated call notifications for district-wide notifications, your home address information for open enrollment or other mailings, and your emergency contact information.

Note: The new version of PeopleSoft has functionality for preferred names; however, that functionality is still being tested and refined. We will let employees know when the function to update your preferred name is available.

If you got married, divorced, or had a baby over the summer, now is also a great time to review and update your beneficiary information with PERA (non-licensed employees) or SPTRFA (teachers/administrators). If you carry life insurance or have a 403b or 457 account, you may also want to update your beneficiary information with those vendors as well.

Tax Information

Information for employees related to tax withholding and year-end tax forms, including publications from the IRS and MN Dept of Revenue, is available on the “Tax Forms and Information” page of the Payroll website. Employees can update their withholding elections through PeopleSoft Self Service at any time.

Questions About Your Pay

Your first and best resource is the Payroll website. We make it a priority to maintain the most current, accurate information there. There is an “Understanding Your Paycheck” help sheet that shows you how to read your pay stub. You can view the Payroll schedule to understand what days worked are included on which payday and when certain deductions such as dues or insurance are taken (or not taken). If you don’t find the answer to your question on our website or have a specific question about the number of hours on your paycheck, you can contact Payroll directly by email or with a phone call. It is difficult for Payroll to accommodate in-office drop-ins because of the nature of the department's deadline-driven work, so please do not stop by in person without a pre-scheduled appointment. To contact Payroll directly, you can email your pay-related questions to payroll@spps.org or call your designated Payroll contact for the fastest service.

Questions About a Qualifying Life Event or Leave of Absence

Your first and best resource is the Benefits website for anything benefits related, including insurance, qualifying life events (marriage, divorce, birth, etc.), leaves of absence (including COVID leaves), and retiree benefits. Employees have 30 days from a qualifying life event to update their benefits. Initiating this change can now be done in PeopleSoft through Employee Self Service. Requesting a leave of absence can also be done in PeopleSoft by completing the leave of absence e-form under the “Employee Forms” section. To connect with a Benefits team member, please email benefits@spps.org.

Benefits Open Enrollment

Open Enrollment this year is an “active enrollment”, which means every benefit-eligible employee is required to re-elect their benefits for calendar year 2023.

- SPFE members (including teachers, SCSP, and EAs) will be staying with PEIP. Active Enrollment for this group will be November 7-18.

- All other employees, including TAs, will be moving from HealthPartners to the new plans with Medica. Active Enrollment for this group will be October 17-28.

Watch for more information coming soon. Communications will be via email, The Bridge, and a home mailer in the coming weeks. Information will also be on the Benefits website as soon as it is available.

One last reminder, please put your employee ID on every form or e-mail that you send to Payroll or Benefits. This helps us identify you in our HR and Payroll system and enter your information correctly. If you do not know your employee ID, email payroll@spps.org and your Payroll specialist will send it to you.

Thank you for all that you do here at Saint Paul Public Schools! We are glad you are here and hope you have a wonderful year.